Hyperscalers like AWS, Microsoft Azure, and Google Cloud Platform (GCP) are commanding massive enterprise budgets. And through their respective Marketplaces, they are streamlining procurement and unlocking co-sell opportunities for ISVs globally.

But which platform aligns best with your go-to-market strategy? This guide breaks it down for SaaS sellers, drawing on the latest trends and data to help you decide.

Quick Takeaways for Busy SaaS Leaders

- AWS Marketplace leads in scale: Ideal if you’re chasing volume with a broad customer base, but expect a steeper revenue cut (up to 40% initially).

- Microsoft Azure Marketplace excels in enterprise depth: Perfect for Microsoft-centric deals, with seamless integration and lower fees for qualified partners.

- GCP Marketplace shines in innovation speed: Best for AI/ML-focused SaaS, offering flexible billing and rapid deployment, though with a smaller footprint.

- The winner? It depends on your stack: As hybrid approaches are rising, many sellers list across all three for diversified reach.

Whether you’re a bootstrapped startup or a Series C scaler, choosing the right marketplace can boost your pipeline by 30-50% through hyperscaler endorsements. Let’s dive deeper.

Executive Overview: Why Marketplaces Matter More Than Ever in 2025

SaaS sellers face a procurement paradox: Buyers crave simplicity, but fragmented tech stacks complicate decisions.

Cloud marketplaces solve this by bringing your solution into trusted ecosystems and ensuring you reach enterprise buyers. According to industry benchmarks, Marketplace-enabled SaaS firms see 2-3x faster sales cycles and 25% higher win rates.

For this guide, we’ve focused on three critical pillars to SaaS success:customer acquisition, monetization mechanics, and operational ease.

We’ll weigh AWS, Microsoft Azure, and GCP against each of these pillars, using real-world data from leading analyses.

Marketplace Fundamentals: A Side-by-Side Snapshot

Before the deep dive, here’s a high-level comparison table tailored for SaaS sellers. Metrics are pulled from 2025 updates, with emphasis on revenue potential, integration depth, and seller support.

| Feature | AWS | Microsoft Azure | Google Cloud |

| Market Share (2025) | ~45% of cloud spend | ~25% | ~20% |

| Revenue Share | 40% Year 1, 20% ongoing | 20% flat for most; 0% for Enterprise | 20% standard; volume discounts available |

| Customer Base | 1M+ active accounts, broad SMB-to-enterprise | 500K+ enterprises, heavy Microsoft tie-ins | 300K+ innovators, AI/ML focus |

| Listing Time | 4-6 weeks | 2-4 weeks | 1-3 weeks |

| Key Strength for SaaS | Volume & visibility | Co-sell with MSFT sales | Flexible billing & Kubernetes-native |

| Top Pain Point | High fees & compliance hurdles | Ecosystem lock-in | Smaller audience |

Sources: Aggregated from Hevo Data, Slashdot, and SourceForge comparisons.

This table highlights why no single marketplace dominates, it’s about fit. AWS powers sheer scale, Microsoft Azure leverages its sales machine, and GCP fuels cutting-edge deployments.

AWS Marketplace: The Volume King for SaaS Expansion

AWS hosts over 20,000 SaaS listings and drives $10B+ in annual seller revenue, setting the gold standard for reach in 2025. For SaaS sellers, it’s a discovery powerhouse: buyers browse pre-vetted solutions alongside AWS services, slashing evaluation time by 60%.

Pros for SaaS Sellers

- Unmatched visibility: Integrated with AWS’s 1M+ customer base, including tools like the AWS Marketplace Console for targeted promotions.

- Co-Selling perks: Access to AWS Partner Network (APN) tiers unlocks joint campaigns.hink dedicated seller managers for top performers.

- Analytics edge: Robust reporting on buyer intent, with 2025 updates adding AI-driven lead scoring.

Cons

- Fee structure bites: 40% introductory cut for high-ACV deals, you may need to compensate for that in your pricing.

- Compliance grind: Rigorous security audits (e.g., SOC 2, HIPAA) add upfront costs, per Slashdot’s GTM breakdowns and audit pricing.

If your SaaS targets mid-market growth, AWS is non-negotiable. Sellers report 40% of pipeline from Marketplace leads alone.

Microsoft Azure Marketplace: Enterprise Co-Sell Mastery

With 15,000+ listings, Microsoft Azure Marketplace is a co-sell haven for SaaS sellers. Microsoft’s 100K+ sales reps actively push qualified partners, turning marketplaces into revenue accelerators.

Pros for SaaS Sellers

- Seamless ecosystem play: Native integrations with Microsoft 365, Dynamics, and the Power Platform mean effortless upselling for CRM-adjacent SaaS.

- Favorable economics: Flat 20% fees (waived for Enterprise Agreement partners) make it seller-friendly.

- Global reach with local flavor: Strong in EMEA and APAC, with 2025 enhancements for multi-geo compliance.

Cons

- Velocity trade-off: While co-sell is gold, it favors Microsoft-aligned solutions. On-native integrations can lag.

- Approval bottlenecks: Though faster than AWS, expect scrutiny on scalability metrics.

For B2B SaaS with enterprise ambitions, Microsoft Azure’s your multiplier. Industry analyses show a 35% ARR lift from joint pursuits, especially in regulated sectors like finance.

GCP Marketplace: The Agile Innovator for Next-Gen SaaS

Google’s underdog status is flipping in 2025. Thanks to Gemini integrators, GCP’s AI boom is drawing data-savvy buyers. At 10,000+ listings, it’s nimbler than the giants, emphasizing open-source compatibility and Kubernetes orchestration.

Pros for SaaS Sellers

- Speed to market: Quickest onboarding, with self-service publishing. Ideal for iterative SaaS updates.

- Billing flexibility: Usage-based metering and 20% fees with rebates for high-volume sellers.

- Innovation hooks: Pre-integrated AI and data tools and integrations make it easy to attract more tech-savvy enterprise buyers.

Cons

- Scale gap: Smaller than AWS/Microsoft Azure, so pair it with broader channels for pipeline diversity.

- Visibility challenges: Not as diverse as the other two hyperscalers, and your success may depend on Google Cloud’s partner ecosystem.

GCP suits AI/ML or DevOps-focused SaaS, with benchmarks highlighting its edge in hybrid cloud scenarios. Early adopters see 25% faster deployments, but volume lags at ~15% of total Marketplace transactions.

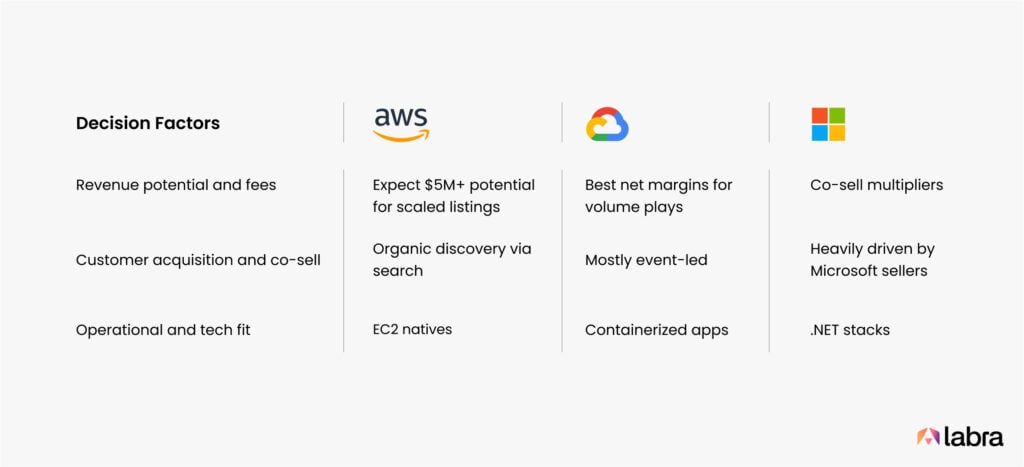

Head-to-Head: Key Decision Factors for SaaS Sellers

1. Revenue Potential and Fees

AWS dominates revenue potential, but at a premium. Expect $5M+ potential for scaled listings. Microsoft Azure balances with co-sell multipliers, while GCP offers the best net margins for volume plays.

Pro tip: Negotiate via partner programs; tiered rebates can drop effective fees to 10-15%.

2. Customer Acquisition and Co-Sell

- AWS: Organic discovery via search.

- Microsoft Azure: Rep-driven pursuits (50% of wins).

- GCP: Event-led (e.g., Google Cloud Next) for niche targeting.

Hybrid sellers on all three capture 60% more leads.

Pro Tip: Maximize co-sell velocity by tagging key ICP deals through AWS’s ACE pipeline early.

3. Operational and Tech Fit

Integration depth varies: AWS for EC2 natives, Microsoft Azure for .NET stacks, GCP for containerized apps. Tool comparisons underscore GCP’s lead in API extensibility.

4. 2025 Trends to Watch

- AI embeddings: All three prioritize, but GCP edges with open models.

- Sustainability mandates: Microsoft Azure’s carbon-tracking tools win over ESG-focused buyers.

- Multi-Cloud rise: 40% of enterprises now mix-list everywhere, but prioritize two.

Pro tip: Align your roadmap with AI-native packaging and ESG tags, early adoption drives faster placement and partner prioritization.

| Trend Impact on SaaS | AWS Opportunity | Microsoft Azure Opportunity | GCP Opportunity |

| AI/ML Integration | Strong via SageMaker | Copilot synergies | Vertex AI leadership |

| Procurement Speed | High volume, slower closes | Enterprise fast-track | Agile for startups |

| Global Expansion | Broadest coverage | EMEA dominance | APAC growth |

Which Marketplace is Best for Your SaaS in 2025?

No one-size-fits-all, but here’s a decision framework:

- Go AWS-first if you’re volume-hungry and AWS-native.

- Prioritize Microsoft Azure for Microsoft ecosystem leverage and enterprise scale.

- Bet on GCP if innovation and flexibility define your edge.

- The smart play: Multi-List. Top Labra clients diversify across platforms, using unified billing tools to streamline ops.

Wrapping Up: How Labra Gets You Listed Across AWS, Microsoft Azure, and GCP in Record Time

Navigating the listing process for even one marketplace can feel like herding hyperscalers. Endless compliance checks, tech integrations, and pricing optimizations that drag on for weeks.

But what if you could launch across all three — AWS, Microsoft Azure, and GCP — in under 30 days?

That’s the Labra difference.

Why Labra? Real Results, Zero Headaches.

- Speed without sacrifice: 95% of our clients go live in under a month versus the industry average of 8-12 weeks.

- Revenue-first focus: We’ve unlocked $20M+ in Marketplace ARR for partners, with built-in fee negotiation tactics.

- All-in-one support: From legal reviews to performance analytics, it’s end-to-end expertise tailored to your stage (seed to unicorn).

Start with a free audit of your fit, then pilot one platform while planning the rest. Don’t let listing delays stall your 2025 growth. Book a demo with Labra, and let’s get you live in every major ecosystem, fast.

FAQs: Cloud Marketplaces for SaaS Sellers in 2025

1. Which cloud marketplace should I prioritize as my first listing if my SaaS is geared toward scaling with high-volume deals in the mid-market space?

AWS Marketplace: Dominates with ~45% cloud spend and 20K+ listings for broad visibility to 1M+ accounts. Expect 40% of pipeline from leads.deal if AWS-native, but hybrid with others for full reach.

2. I’m trying to budget for SaaS listings,what do the revenue share fees look like across AWS, Microsoft Azure, and GCP right now in 2025?

- AWS: 40% Year 1, 20% after.

- Microsoft Azure: 20% flat; 0% for Enterprise partners.

- GCP: 20% base, rebates to 10-15% for volume. Negotiate programs for 2x ARR uplift.

3. How much time should I really expect to invest in getting my SaaS product approved and live on these cloud marketplaces this year?

- GCP: 1-3 weeks (self-service AI/ML focus).

- Microsoft Azure: 2-4 weeks (enterprise vetting).

- AWS: 4-6 weeks (compliance-heavy). Expert partners shave it to <4 weeks platform-wide.

4. For a SaaS solution that’s deeply embedded in enterprise workflows, what makes Microsoft Azure Marketplace stand out as the go-to option?

Co-selling powerhouse: 100K+ Microsoft reps push partners for 35% ARR gains, especially in finance/CRM via 365/Copilot integrations.

5. Even if my SaaS isn’t heavily into AI, is it still worth pursuing a GCP Marketplace listing given its relatively smaller user base?

Yes. For container/Kubernetes plays, GCP offers 25% faster deployments and a 15% hybrid transaction share. You can boost volume by pairing with AWS.

6. In what ways are cloud marketplaces actually shortening sales cycles and improving close rates for SaaS teams like mine?

Cloud marketplaces cut cycles 60%, lift wins 25%; 70% of enterprise buys start here. Multi-listing adds 60% more leads for scalers.

7. What emerging trends in 2025 should I be factoring into my decision on which marketplace to bet on for my SaaS growth?

- AI/ML: GCP (Vertex edge), AWS (SageMaker), Microsoft Azure (Copilot).

- Multi-Cloud: 40% enterprises hybridize, list on all three Marketplaces.

- ESG: Microsoft Azure leads in carbon tracking. Align to stack: AWS for coverage, Microsoft Azure EMEA, GCP APAC.

8. Is there any wiggle room to negotiate down fees or snag waivers when listing on these platforms as a SaaS seller?

Definitely, via APN (AWS), IP Co-Sell (Microsoft Azure), or GCP tiers for rebates/managers. Volume sellers hit 10-15% effective; free audits reveal your leverage.

9. What’s the deal with all the compliance requirements for AWS Marketplace, and how can I navigate them without derailing my launch?

SOC 2/HIPAA audits spike upfront costs but gate access to $10B+ in revenue. Partner for reviews:95% go live in <1 month.

10. As a bootstrapped startup, does it make sense to spread my SaaS listings across multiple marketplaces like AWS, Microsoft Azure, and GCP from the get-go?

Absolutely, it unlocks 30-50% pipeline surge without lock-in. Pilot GCP for speed, unify billing for ops. Labra can map your hybrid path.

Book a demo to customize.